Building homes is a very complex thing. The National Association of Home Builders estimates that over 3,000 components are used in constructing a house. The single most problematic component for Residential Warranty Company, LLC (RWC) is the foundation, a wall of concrete block resting on a footing, supporting the full weight of the house, its contents, and inhabitants. This component is arguably the most important component. Why then is it the most problematic?

Building homes is a very complex thing. The National Association of Home Builders estimates that over 3,000 components are used in constructing a house. The single most problematic component for Residential Warranty Company, LLC (RWC) is the foundation, a wall of concrete block resting on a footing, supporting the full weight of the house, its contents, and inhabitants. This component is arguably the most important component. Why then is it the most problematic?

When designing and constructing a concrete block (CMU) foundation there are many very important elements that need to be considered. The single biggest dynamic that we are faced with is resistance to lateral movement. The forces that laterally impact CMU foundations should be considered when using this method of foundation construction. Steel reinforcement, introduction of pilasters, solid grout along with rebar in hollow cores and attention to backfill and soil types go a long way in constructing an adequate foundation wall that can resist lateral forces.

There are external factors that can affect CMU foundation performance. The height of the backfill along with the type of soil (clay, shale, sandy, expansive, etc.) may have required special attention when it was placed. The installation of perimeter drain systems whether internal or external will be evaluated. Is a sump pump installed and has the homeowner been proactive in using and maintaining the system? If the system is day lighted, is the line clear and does it function properly? Hydrostatic pressure created from over saturated soil has tremendous weight that can test the limits of the foundation wall if a potential water condition is not mitigated.

When a claim is made to RWC, a fact-finding inspection is ordered. A licensed professional engineer is scheduled to visit the home and assess all aspects of the condition reported. RWC will contact you and ask for any documentation you have regarding the construction of this home. If upon review of the fact-finding inspection report in relation to the Limited Warranty applicable to the home, the condition of the defect meets the specified criteria for coverage, RWC is obligated to take action. In most instances the mode of foundation movement is lateral and our responsibility is to restore the load-bearing function of the foundation wall. The engineer will evaluate the unbalanced fill condition as he evaluates the foundation wall. Any actions that the homeowner may have taken regarding landscaping, patio installation, modifications to the downspout locations or re-routing of the downspouts along with overall grading and drainage that may have been modified after the home was delivered by the Builder, are noted and taken into consideration.

During this phase of the claim, RWC will again reach out to your company. As the Builder, you have the most knowledge about this home. You have been intimate with this structure from the first idea that a home should be constructed until settlement changes title to your buyer. We understand and respect that you are most knowledgeable. We rely on your expert knowledge and ask that you provide us with the details regarding how this foundation was designed and built. This will include requests for drawings and details regarding any service orders or warranty claims that you have dealt in the first two years of the homes life. Anything that you can provide to us so we can carefully evaluate every aspect of this covered condition.

RWC will be required to provide a settlement offer, or in some cases, make repairs that will restore the load-bearing function to the CMU foundation. We are not obligated to rebuild the foundation wall however this may be necessary dependent on the severity of the lateral displacement. Our efforts commonly involve reinforcement utilizing solid core grouting and rebar installation and more recently the use of carbon fiber reinforcement. This work is most often performed from the interior of the home negating the extensive cost of exterior excavation. It is important to recognize that this work will be accomplished in accordance with a sealed structural repair plan provided by a licensed engineer and the work will be certified at completion by the same professional. Remember, the Limited Warranty requires that the load-bearing function be restored, that does not necessarily mean that a wall that shows signs of lateral movement needs to be plumb when the repairs are complete.

RWC understands that you are truly professional Builders. When we have to deal with this significant structural problem we know you have done your due diligence throughout the construction process and you will be able to provide us with the important data we need to ensure a fair evaluation of the claim and an adequate repair when required.

Written by Don Sechler, RWC Warranty Resolution

The new home building industry saw positive improvements over the past few years and continues to be on the upswing. The nation’s vacant home inventory is becoming depleted and new homes are being built to meet the demand. Buyers have more confidence so not only are homes being built, but they’re being bought.

What are you doing to entice buyers and set yourself apart from your competitors? What kind of bells and whistles are you including in your homes that other builders are not? How are you promoting your quality and strength? What’s your response to a potential buyer when they ask, “What if I have a problem in my home?”

That’s a real concern for buyers. None of us can forget how difficult the economy has been in the past. Home buyers, especially want to be assured they’re getting the most for their money and that they’re purchasing a home from a reputable, quality builder.

By providing RWC’s warranty, you’re proving to your customers that if there’s a problem in their home, it will be corrected. We investigate all of our members. We want to be sure RWC members have a solid reputation, build a quality home, have financial strength, and provide excellent customer service. You don’t just subscribe to RWC. You earn your membership, so be sure to proudly include and display the fact that you’re an RWC member. Add our logo to your printed materials and media advertising and add a link on your website to our Homeowners page.

This will also help you compete against resale homes on the market. Most resale homes include a third party warranty. Quality, reputation, reliability, warranties and assurance are all very important factors in a home buying decision.

Have you ever had a difficult homeowner after the sale? RWC can help you there, too. Our dispute resolution process is extremely effective. We have trained individuals that assist you and your homeowner through a free mediation process. Mediation is efficient and effective. From time to time, a homeowner isn’t satisfied with the outcome. For those occasions, binding arbitration is available. Again, RWC’s staff assists the parties through this process. It’s not necessary for you to hire an attorney.

Now that homebuilding is gearing up again, be sure to emphasize your advantages. Don’t miss out on sales because you didn’t promote yourself adequately. In addition to your company’s profile information, be sure to advertise that you provide an insured, third party warranty from the nation’s largest warranty company. The benefits are numerous for your homebuyers and for you.

One of the many advantages of your membership in the RWC Warranty Program is the marketing support available for your use. You can enhance your sales strategy for today’s competitive marketplace by taking full advantage of RWC’s marketing essentials. Best of all, they are FREE!

One of the many advantages of your membership in the RWC Warranty Program is the marketing support available for your use. You can enhance your sales strategy for today’s competitive marketplace by taking full advantage of RWC’s marketing essentials. Best of all, they are FREE!

Below are a few examples of what is available, but feel free to browse our marketing materials page to see what best suits your needs. Consumer brochures are also available to pass onto your homeowners so they can better understand the warranty on their home.

- Electrical Box Sticker (form # 204): This self-adhesive sticker makes it easy for your homeowners to find their warranty validation number. Affix this sticker to their electrical box during your final walk-through inspection.

- Small vertical Easel (form # 509): Sometimes space is limited on countertops. When that’s the case and our full-size easel or brochure holder doesn’t fit, try this smaller version. Works great in sales offices and model homes!

- Static Cling Window Decals (form #533): This cling is perfect for windows in model homes, sales offices or even homes under construction. This static cling decal will let your prospective buyers know that their home will be protected with an RWC warranty.

HOW TO ORDER SUPPLIES:

Order Online through Warranty Express (top right corner of webpage). Call us if you still need a password to login.

Email: info@rwcwarranty.com and let us know which items you are interested in.

Phone: 800-247-1812, Ext 2459

We ask that you please order only a 2-3 month supply to ensure that you receive the most current materials.

If you’ve been a builder for more than a few years you’ve been through a lot. When the housing bubble burst; you survived. Now that the market is better and your business is growing, you’re starting to realize the rewards of surviving. There are still plenty of challenges and one of them is to find qualified subcontractors.

If you’ve been a builder for more than a few years you’ve been through a lot. When the housing bubble burst; you survived. Now that the market is better and your business is growing, you’re starting to realize the rewards of surviving. There are still plenty of challenges and one of them is to find qualified subcontractors.

Recently, you started a new subdivision and hired a flat concrete contractor you’ve never worked with before, to put in the sidewalks. This morning you got a call from your new sub; the kind you never want to get. A woman was walking her dog next to your project around dusk last night. She tripped over a mason’s line that was left across a section of sidewalk that had been poured earlier that day. The new flat work guy left the site without setting up any cones, fencing or signs. In fact, he did nothing to warn the public of what is commonly referred to as a “trip & fall hazard.” The woman suffered fractures to both wrists as well as lacerations to her face when she fell. Her injuries will require surgery and she’ll be unable to work for several months. Her pain and suffering have yet to be determined.

Your new sub has his own general liability insurance that should respond to this claim. You required him to have his insurance company add you to his policy as additional insured. That way they will defend you if and when the woman’s attorney sues you as well as your sub. The certificate of insurance you required your sub to provide shows all of this. Everything should be fine. But, trip & fall claims can spiral out of control.

Disputes can arise over who should have protected the worksite. Subcontractors or, their attorneys, can argue that’s the general contractor’s job. You feel that you don’t have time to hover over every job site making sure each sub is placing the proper emphasis on safety. Besides, you hired them to do a job and that includes doing it safely. Doesn’t it? All your subs understand this, don’t they?

In most states, you as the general contractor, are ultimately responsible for worksite safety. That doesn’t mean the subs get a free pass. But it usually means the general contractor has to do more than just assume everyone is being safe. That means holding periodic safety meetings, making sure new subs understand what you expect from them before starting work each morning, during the workday and after shutting down for the night. Active worksites are dangerous places even when they are nothing more than a partially completed sidewalk in poor light where an unsuspecting woman takes her dog for a walk.

Holding regular safety meetings doesn’t have to take a lot of time or cost you much money. Meetings don’t have to be held every day; just regularly enough to make it clear to everyone concerned that you are committed to preventing accidents involving both the public and anyone else at your worksites.

The RWC Insurance Advantage is dedicated to loss prevention. To prove it, we offer up to 25% off your new general liability premium if you provide us with a copy of your written safety program. If you’re already insured with us, we’ll even offer the same incentive on your next renewal if you haven’t already received it.

Call us today at 866-454-2155 to find out if you qualify and receive a free, no obligation quote.

Today’s home buyers are tech-savvy shoppers who routinely turn to the internet when searching for new homes. As a successful builder, you understand the vital importance of maintaining a solid presence on the internet so potential buyers can find you, learn about what you offer, and discover what makes you better than “the other guys”.

RWC has an entire section of our website dedicated to educating the homebuyer on everything from how to choose a home builder to understanding what a new home warranty is all about. The following resources can help explain the value of your decision to provide an RWC warranty on your home:

RWC has an entire section of our website dedicated to educating the homebuyer on everything from how to choose a home builder to understanding what a new home warranty is all about. The following resources can help explain the value of your decision to provide an RWC warranty on your home:

- The Value of an RWC Warranty to Your Home Buyer

- What Your RWC Membership Means to Your Buyer

- Tips on Choosing a Builder (of course being an RWC Member factors in there)

- What’s the Difference Between a Structural Warranty and an Appliance Warranty

- Important Warranty Terms to Know and Understand

Something ‘extra’ you provide which sets you apart from the competition is the fact you offer a 3rd party insured warranty – and not just any warranty – but the RWC warranty. The sales process is complex with a variety of topics to discuss with potential home buyers. Our goal is to make the warranty explanation easier for you by expanding our online resources for your homebuyers. Hopefully, this section will become your “go to” resource for warranty information for your staff and your buyers.

Obviously, it makes perfect sense to provide your buyers with information about your warranty. Simply link your site to the RWC Homeowner section to point them in the right direction and we’ll tell the story for you! We suggest linking to www.rwcwarranty.com/homeowners as your starting point. Your buyers will learn about the extra mile you travel to demonstrate your professionalism and customer service by providing them with this written RWC warranty.

Did you know that as a member of RWC or HOME of Texas you may be eligible for our General Liability Insurance Program through RWC Insurance Advantage? If you would like to learn how we might meet your general liability coverage needs, call RWC Insurance Advantage today at 866-454-2155 or click here to get a quote. Plus, be sure to read on for some helpful hints about certificates of insurance, subs and staying on top of policies.

Did you know that as a member of RWC or HOME of Texas you may be eligible for our General Liability Insurance Program through RWC Insurance Advantage? If you would like to learn how we might meet your general liability coverage needs, call RWC Insurance Advantage today at 866-454-2155 or click here to get a quote. Plus, be sure to read on for some helpful hints about certificates of insurance, subs and staying on top of policies.

Insurance agents hear it all the time; are certificates really that important? If my subs’ certificates aren’t current, am I on the hook for what their policies don’t cover? What about exclusions on my policy? Maybe a hypothetical claim will help provide some answers. Let’s say you contract with a roofer. He’s not the roofer you usually work with but, he has a good reputation and he gives you a certificate of insurance that shows he has his own General Liability policy. It has the same limits as your policy with the RWC Insurance Advantage program. No worries here. His policy will respond first to injuries or damage to others that he might cause while working on your behalf. However, you also notice his Workers Comp is due to renew in about a week but, he assures you the renewal is going to happen and he’ll provide you with an updated certificate just as soon as he gets it from his agent. You need to get your latest project under roof as soon as possible because the weather has been uncertain; so, you decide to take a chance. Besides, it shouldn’t take a week to do a roof. What could go wrong?

The weather takes a turn for the worse. By the time the roof is started it’s been over a week. Then you get the news one of the roofer’s employees has been injured. He didn’t fall but, he hurt his back. Only then do you remember the promised certificate hasn’t appeared. Then your roofer admits his policy was not renewed because he failed to make a payment. Your policy doesn’t cover injuries to the employees of subcontractors. That’s because workers compensation insurance is available to them and is designed to cover the medical bills and lost wages of his employees. As it turns out, waiting for a renewal certificate of insurance might have avoided you being held liable for a loss that isn’t covered under your policy.

• Make sure all your subcontractors provide you with up-to-date certificates of insurance.

• Ask them if they have any open or, unreported claims.

• Be aware of what your policy does and does not cover.

Don’t let someone else’s lack of planning become your problem.

Source: nahb.com

Whole house remodels and additions are regaining market share according to a 2016 survey of remodelers released by NAHB Remodelers, the remodeling arm of the National Association of Home Builders (NAHB). The survey revealed the most common remodeling projects in 2016, compared to historical results of the survey.

“While bathroom and kitchen remodels remain the most common renovations, basements, whole house remodels and both large and small scale additions are returning to levels not seen since prior to the downturn,” stated the 2016 NAHB Remodelers Chairperson. “Clients want to add more space, but remodeling a significant portion of the home is no easy feat. That’s why it is important to work with a professional remodeler who has the integrity and expertise to take on these large remodeling jobs.”

Remodelers reported that the following projects were more common than in 2013:

Remodelers reported that the following projects were more common than in 2013:

• Whole house remodels increased by 10 percentage points

• Room additions increased by 12 percentage points

• Finished basements increased by 8 percentage points

• Bathroom additions increased by 7 percentage points

Bathrooms topped the list of most common remodeling projects for the fifth time since 2010. Eighty-one percent of remodelers reported that bathrooms were a common remodeling job for their company while 79 percent of remodelers reported the same for kitchen remodels. Window and door replacements decreased to 36 percent from 45 percent in 2014.

Whether you are currently working on remodeling projects due to the colder weather and frozen ground or because that's what your customers are opting for, Residential Warranty Company, LLC & HOME of Texas have great remodeler warranty options at your fingertips. When it comes to revamping space, creating an addition to a home, or totally reinventing the look and style of a home, homeowners want to know the work is being done by a quality, professional remodeler. Contractors who offer the RWC warranty / HOME warranty provide clients with written, insured warranty protection, including a dispute resolution process.

It takes a lot of tools to both complete a remodeling project and to build a business. RWC / HOME offer you a great selection of tools. Talk to your account executive today for more details on the remodeler warranty, or any program available in our menu of choices.

Source: proremodeler.com

Source: proremodeler.com

Readers of news articles about the housing industry have been inundated for a while with stories about Millennials and their desire to live in the city. Headlines such as “Millennials Prefer Cities to Suburbs, Subways to Driveways” and “The New American Dream Is Living in a City, Not Owning a House in the Suburbs” popped up frequently. And polling companies provided the data to back it up: The Nielsen Company, for example, reported that 62 percent of young people “like having the world at their fingertips,” preferring to live in “dense, diverse urban villages where social interaction is just outside their front doors.”

But around the middle of 2015, the stories about Millennials started to shift. We began to see more stories like, “Think Millennials Prefer the City? Think Again …” And now, a survey from the National Association of Realtors says that Millennials are finally starting to buy homes. And where are they buying them? That's right, in the ’burbs.

Why all of a sudden the change? Perhaps Millennials are now ready to settle down and start families and prices are cheaper in the suburbs. Or because they want to raise their kids in places that remind them of their own childhood. Whatever the reasons, the numbers show that buyers under the age of 35 now make up the largest share of homebuyers (35 percent) and that 51 percent of them bought homes in the suburbs or in subdivisions.

It stands to reason that these buyers, whose median age is 30, are the leading edge of their generation. As the rest of this generation, 80 million strong, reach their 30s, they will likely follow the same path—research from the Demand Institute says 75 percent of Millennials consider homeownership an important long-term goal and 48 percent say they plan to buy within the next five years. The question is, are you building homes they will want to buy?

So what exactly does this young group want? Turns out they want pretty much the same things almost everyone else wants: a nice neighborhood; good schools; access to public transportation; & convenient outdoor space to walk and exercise. Another requirement is close proximity to social activities such as shops, cafés, and restaurants. As for the house itself, they are looking for an open plan, ample storage, energy efficiency, low-maintenance living, space for easy entertaining, and of course good cell reception. But the single most important thing Millennials are looking for is living within their means in a home they can comfortably afford.

Unfortunately, the problem is, there just aren’t enough new homes being built that Millennials can afford. Because of land and labor costs, zoning and other regulations, most builders are targeting a smaller, more affluent group of buyers. A lot of new homes are large and include more expensive features and amenities. Something that a young, first time home buyer, will probably pass right by because it is out of their price range. A recent study by real estate advisors RCLCO revealed that when first-time buyers considered new and existing homes in their searches, only 18 percent of them bought a new home.

There are some success stories out there, though. RCLCO reports that a concerted effort by some master planned communities to offer a range of product types, such as townhomes, cottage court bungalows, and small single-family homes—in addition to conventional single-family homes — “can still achieve premiums on a dollars-per-square-foot basis.” The company cites the Daybreak master plan near Salt Lake City as a good example of a project that successfully integrates midscale, mid-priced product within a larger community.

Companies that are building more affordable homes and marketing them to Millennials are already starting to reap the rewards. It’s time for more builders to start thinking about creating a product that is attainable for the largest faction of buyers we may ever see.

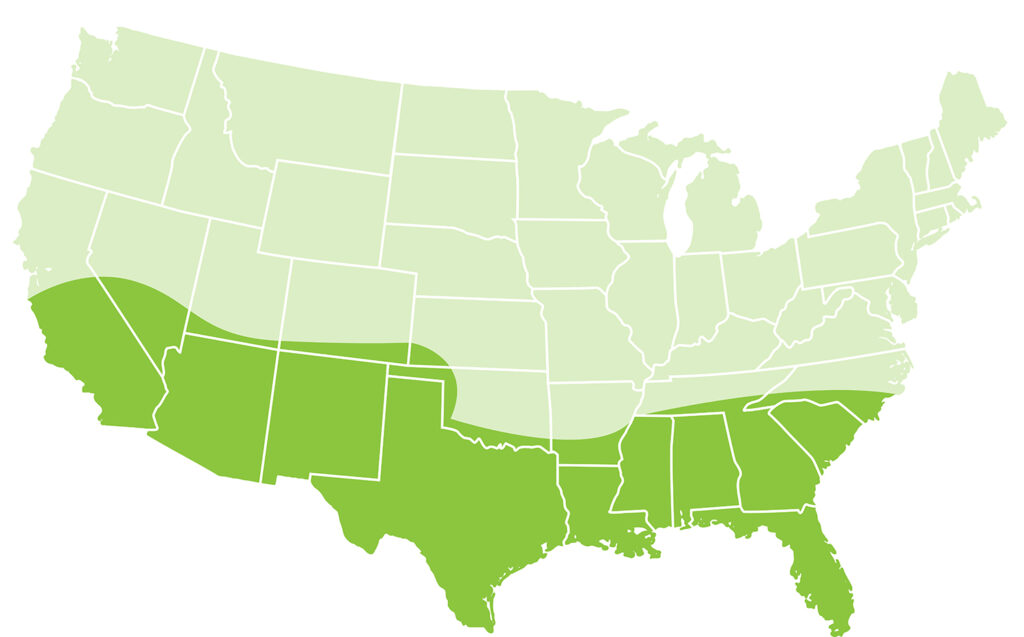

Builders, manufacturers and remodelers have new opportunities moving their way. As Sun Belt City populations grow, the need for new homes, remodels, additions and communities arise. Protect your investment with an RWC, HOME of Texas or MHWC warranty. Not only will the warranty limit your liability and give you the competitive edge, but it will also add value to your home and give your homebuyer that peace of mind they crave. Read on to learn more about this shift to warmer climates and be sure to take advantage of the many benefits RWC and affiliates have to offer.

Builders, manufacturers and remodelers have new opportunities moving their way. As Sun Belt City populations grow, the need for new homes, remodels, additions and communities arise. Protect your investment with an RWC, HOME of Texas or MHWC warranty. Not only will the warranty limit your liability and give you the competitive edge, but it will also add value to your home and give your homebuyer that peace of mind they crave. Read on to learn more about this shift to warmer climates and be sure to take advantage of the many benefits RWC and affiliates have to offer.

The sun is shining, literally and metaphorically, on many states located within the Sun Belt. New data from the U.S. Census Bureau reveals that more people are choosing to leave the northern regions of the country, especially the Midwest, to settle in warmer climates.

The data includes population estimates and analysis of population changes for U.S. counties and metro areas, providing statistics for total population change, shifts in population due to natural increase, and domestic and international migration between July 1, 2014, and July 1, 2015, the Joint Center for Housing Studies of Harvard University reports.

The general trend shows that Sun Belt counties and metros — specifically, suburban counties in the South — are attracting the most new residents.

Texas, in particular, has been drawing people from other parts of the country, with Houston and Dallas-Fort Worth experiencing more growth than anywhere else in the U.S., gaining 159,000 and 145,000 people, respectively. A little further down the list are two other Texas metros, Austin-Round Rock and San Antonio, each of which grew by about 50,000 people. Combined, the population gain for these four Texas metros is 412,000, the highest total for any state. Florida, California, Georgia, and Washington round out the top five.

The counties that experienced the greatest population growth were also located in the southern and western regions of the Sun Belt. Harris County, Texas, and Maricopa County, Arizona, were the top two. All of the top 30 counties, in terms of population growth, were located in the West or the South.

Further breakdown of the overall population gains shows that Americans are seeking the sun. Domestic migration was also trending toward Sun Belt states with the top 10 counties for net population influx being located in Arizona, Florida, Nevada, and Texas. Many of the counties that appealed to domestic migrants also appealed to international migrants. However, some places, such as Los Angeles County, had high international migration but actually lost domestic migrants.

On the flip side, among the top 100 metros, Chicago had the biggest net population loss, with a drop of 6,200. Pittsburgh was next, losing 5,000 residents.

Source: Professional Builder

When a builder provides a warranty on a newly built home, what exactly does that mean to your buyer and to you? It means protection, security, peace of mind and value. And a warranty from Residential Warranty Company, LLC will provide just that. One of the least expensive, longest lasting products a builder can purchase for the homes they build is an RWC warranty.

When a builder provides a warranty on a newly built home, what exactly does that mean to your buyer and to you? It means protection, security, peace of mind and value. And a warranty from Residential Warranty Company, LLC will provide just that. One of the least expensive, longest lasting products a builder can purchase for the homes they build is an RWC warranty.

So why exactly is RWC your best choice?

OPTIONS: The RWC “Menu of Choices” allows you the ability to offer the best Warranty program for your business. From our FHA/VA accepted Standard 10 Year Warranty to our Day 1 Coverage Warranty to our Customized State New Home Warranty to our Remodelers Warranty and more, we have what your business needs.

FLEXIBILITY: RWC’s members are able to pick and choose which Warranty options to use and which projects they wish to enroll. We do not require 100% enrollment on detached homes.

MARKETING FEATURES: RWC provides its members with FREE attractive marketing materials to help promote your business and set yourself apart from your competition.

EASY: RWC offers online enrollment, the ability to order marketing materials, renew memberships and run reports through Warranty Express.

EXPERIENCE: RWC has been in business for 35+ years and has warranted over 3 million homes to date. The average tenure of our employees is 18 years.

STRENGTH: RWC’s insurer, Western Pacific Mutual Insurance Company (WPMIC), A Risk Retention Group, is A.M. Best rated “A- (Excellent)”. WPMIC insures only our thoroughly screened builder members and no other catastrophic risks such as planes, trains or automobiles, which can affect an insurer’s strength and equity. Less risk equals more strength. In fact, WPMIC currently has over $111 million in surplus equity.

CREDIBILITY: RWC’s membership criteria presents us with the strongest builder members. This screening process reinforces your credibility as an RWC member.

PROTECTION: RWC offers FREE mediation. When needed, binding arbitration is also available. Both offer effective resolution for Warranty disputes. This reduces your risk of litigation and legal fees.

ADVOCACY: RWC provides support to the Home Building Industry through our involvement and financial contributions as a member of local, state and national Home Builder Associations across the United States.

Our mission is to provide a level of security to homeowners and Builders alike. We can help you in maintaining or improving your customer service, define and limit your liability, and provide the warranty and insurance products your company needs. For more information, don’t hesitate to call 800-247-1812 x2149 or email sales@rwcwarranty.com.